Wealthfront College Savings White Paper

Publication date: July 24, 2018. The information in this white paper is accurate as of this date. When we make material updates, we will also update the publication date.

Introduction: The challenge of saving for college

Saving for college is one of the most frequently discussed investment goals among Wealthfront clients. Many of our clients are starting families and are committed to helping their children finance a college education. In planning for this goal they face a complex set of savings and investment challenges.

Data compiled by the College Board shows that the cost of attending college has increased significantly faster than inflation over the last 45 years. The cost of attending a four-year in-state public college, including tuition, fees, room and board (TFRB) has grown at an average annual rate of 2.0% above inflation, and the cost of attending of a four-year private college has grown by an average of 2.2% above inflation.

The average annual TFRB is currently $19,548 at a four-year in-state public college, and $43,921 at a four-year private college. The average annual TFRB for the 2033-34 academic year will be $39,600 for the average public college and $92,107 for private college, assuming continued cost increases at historical rates over the next 18 years. This translates to a total cost of $158,402 and $368,428 for a four-year degree at public and private colleges, respectively.

These figures, combined with the relatively short investment horizon (as compared to retirement planning) frame the challenge of financing a college education. Clients who talk to us about this goal often grapple with several important related questions:

- What kind of account should we use to save for college?

- How much should we save, given the ever-increasing costs of college, the choice between public and private schools, and the complex math of financial aid?

- What kind of investment portfolio is appropriate for college savings given our risk tolerance?

- How should the investment risk be managed as our child approaches college?

This white paper is intended to help our clients start to address these issues. The analysis below compares various saving options, focusing primarily on optimizing savings plan performance through increased tax-efficiency. Our analysis concludes that the tax advantages of a 529 account make it the superior vehicle for college savings.

Comparing College Savings Account Types

There are four potential ways to save for college:

- Open a 529 account

- Open a Coverdell Education Savings Account (ESA)

- Open a Custodial Account (UTMA/UGMA)

- Open a taxable account

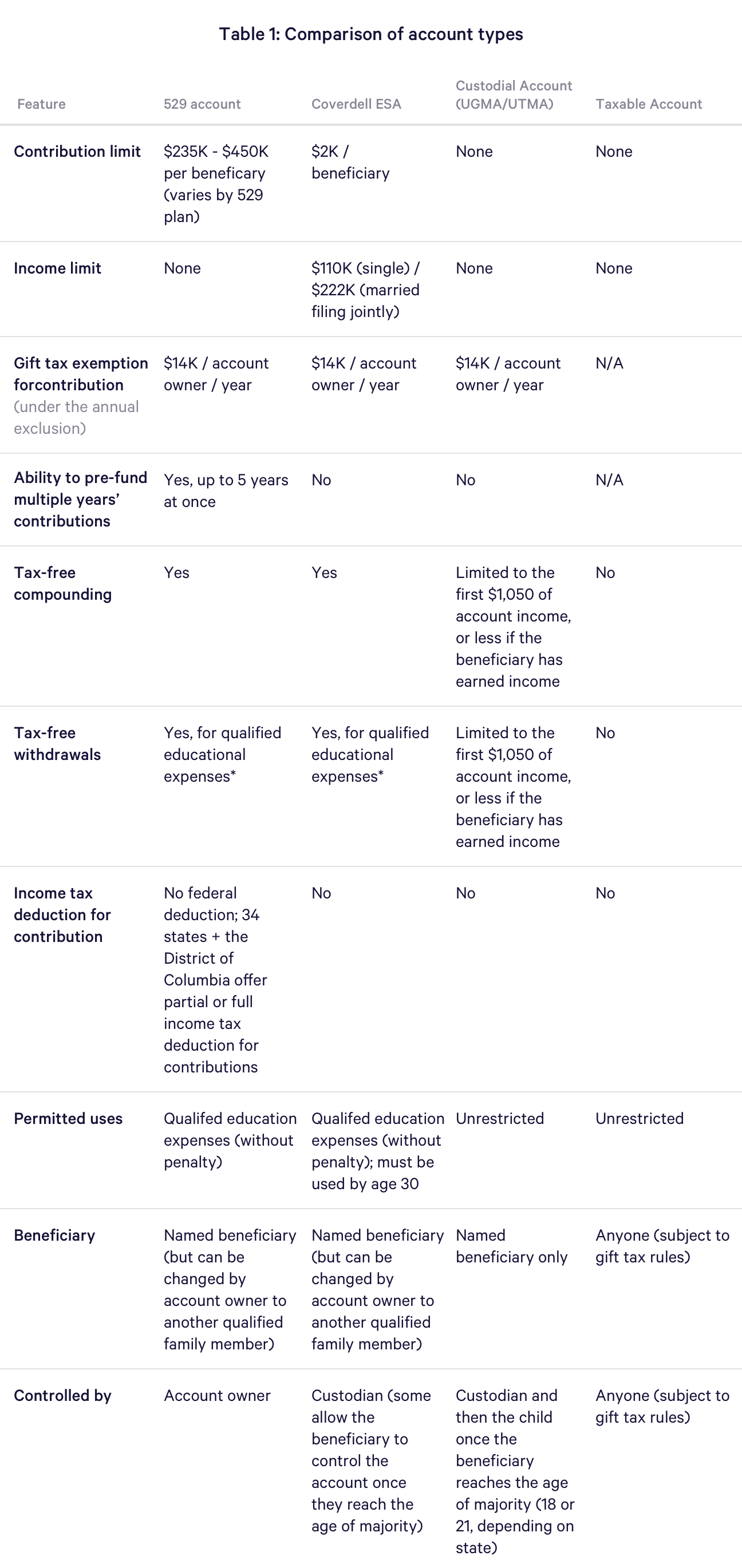

Exhibit 1 analyzes each of the four account types based on their tax efficiency, breadth of use and flexibility with regards to control. Tax efficiency is measured by the four ways to minimize taxes (1) the ability to compound income tax-free; (2) the ability to withdraw funds tax-free; (3) the ability to earn a tax deduction for contributions; and (4) the ability to avoid gift taxes when saving and paying for college. Breadth of use refers to the ability to use the account for something other than education expenses and control flexibility refers to the ability of the person who funds the account to limit how much control the student/beneficiary can exercise over the account.

* While most states exempt gains on qualified withdrawals from income tax, Alabama only exempts qualified withdrawals from the Alabama 529 Plan; withdrawals from out-of-state plans are subject to Alabama state income tax. Illinois exempts qualified withdrawals from the Illinois 529 plan and also from some, but not all, out-of-state plans.

Compound tax-free

529 and Coverdell accounts are similar to IRA accounts in that they permit investments to compound tax-free. In contrast, taxable and custodial accounts subject dividends, interest payments and realized capital gains to annual taxes. However, the first $1,050 of investment income from custodial accounts is exempt from federal taxes and the next $1,050 is taxed at the child’s tax rate, which is typically lower than the parents’ tax rate. The remainder of income in a custodial account is typically taxed at the parents’ tax rate under the Kiddie Tax.

Withdraw tax-free

Like a Roth IRA, withdrawals from 529 and Coverdell accounts are tax-free as long as they are used for qualified expenses such as tuition, fees, books, room and board. For Coverdell accounts these qualified expenses include elementary and secondary school costs, while 529 accounts can only be used for college and graduate school.

A college savings account is typically liquidated and withdrawn over four years. For a taxable account, taxes incurred on capital gains realized at liquidation may further reduce the amount that can be applied to fund college education. In a custodial account, families are likely to recognize capital gains well in excess of the $2,100 exempted or taxed at the child’s rate, which means the majority of capital gains will be taxed at the parents’ tax rate.

Tax deductions for contributions

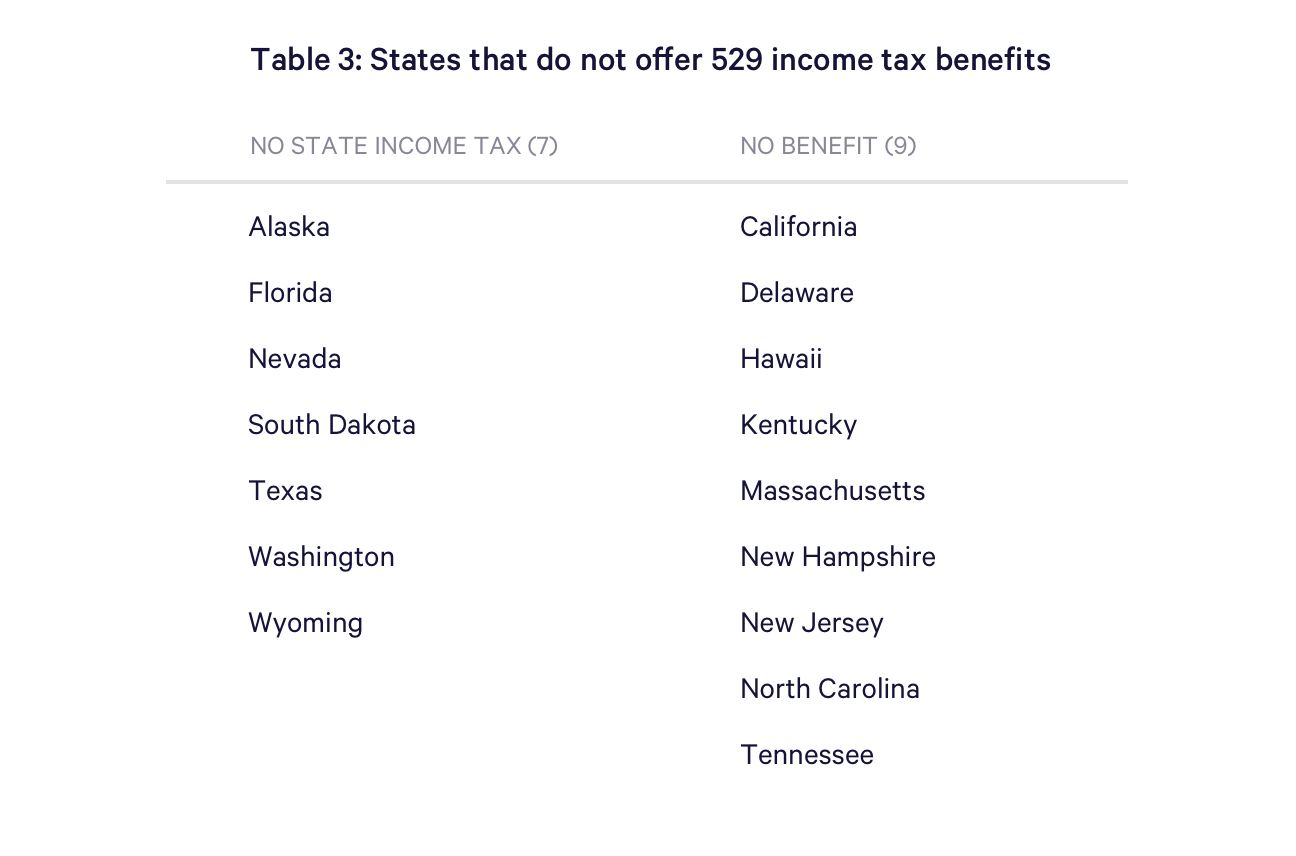

There are no federal tax deductions or credits for 529 contributions, but many states offer an income tax deduction or credit. Federal law requires that all 529 plans have a state sponsor, but leaves the specifics of a tax deduction to the discretion of the individual states. Exhibit 2 shows that of the 43 states with an income tax, 33 states and the District of Columbia offer a deduction or credit for 529 contributions. Only six of those states offer a deduction for contributions to both out-of-state and in-state 529 plans (account owners may contribute to most states’ 529 plan regardless of their state of residency). The remaining 27 states and the District of Columbia require contributions to an in-state plan to receive a tax benefit. The majority of these states also limit the size of the deduction or credit, with an average deduction limit of $8,530 per year for married couples filing jointly.

* Donors over age 70 can deduct an unlimited amount of 529 contributions.

Exhibit 3 lists states that do not offer any 529 tax breaks either because they don’t have a state income tax or they don’t offer benefits.

There are no federal or state income tax deductions or credits for contributions to Coverdell, taxable or custodial accounts.

Avoid gift taxes

While paying for a child’s education rarely incurs gift tax, several gift tax rules shape how families pay for college. As shown in the table above, the annual gift tax exclusion can be applied to 529, Coverdell and custodial account contributions. Of the three, only 529 accounts allow pre-funding of up to five years of exempt gifts at inception (and again at subsequent five year intervals) to maximize the benefit of tax-advantaged compound growth. This pre-funding requires the account owner use five years’ worth of annual gift-tax exemptions, meaning that exemption cannot be used for any other gifts to the same beneficiary for five years. Once assets have been contributed, they are not subject to gift tax at withdrawal.

A taxable account remains owned by the account owner (minors cannot own non-custodial accounts) and therefore has no gift tax implications at funding. At withdrawal, tuition paid from a taxable account directly to a school is qualified for an unlimited educational exemption from gift tax. However, payments for room, board and other costs technically do not qualify for this exemption. Families are required to file a gift tax return if this amount, combined with other gifts to the same beneficiary, exceeds the $14,000 annual exclusion (although, in our experience, this is rarely followed or enforced).

Beneficiaries and account control

529 accounts were created as an incentive to help parents fund their children’s education. They may only be used without penalty to fund qualified college and graduate school expenses. However, they offer significant flexibility with regards to whose expenses the account funds. The account owner retains control of the 529 account she sets up. She may even change the beneficiary to another qualified family member at any time. For example she may create an account for a nephew and then switch it when she has her own child. This allows you to get started much earlier if you so desire.

Coverdell account owners also have the ability to change beneficiaries. Unlike 529 accounts, Coverdell accounts are required to distribute any remaining assets to the beneficiaries once they turn 30. These distributions may be subject to taxes and penalties if they are not used for qualified expenses.

Custodial accounts have no restrictions on permitted use, but can only be used to benefit the original named beneficiary. When funding a custodial account, the account owner makes an irrevocable gift to that beneficiary and cannot easily change beneficiaries in the future. In addition, the beneficiary takes ownership of the account and can do with it what she wishes once she reaches the Age of Majority (18 or 21, depending on the state).

A 529 account therefore provides parents greater control over how the account is used.

Impact on financial aid eligibility

Many families worry that a college savings plan will reduce their potential financial aid and result in a higher expected family contribution (EFC). Even though their assets are included in the EFC calculation, parents’ 529 and taxable accounts have a much smaller impact on the EFC than assets held in the student’s name (for example, in a custodial account). In addition, while taxable account withdrawals can lead to taxable gains that will impact EFC calculations, withdrawals from a parent-owned 529 account are not counted as income for this purpose. Therefore, holding assets in a 529 account should have a relatively small impact on EFC, particularly as compared to alternatives.

Combining a 529 account with federal college tax deductions and credits

For some families, federal tax deductions and credits for college expenses can be more valuable than the tax benefits from a 529 account. IRS rules prohibit families from using 529 accounts to pay for specific college expenses and then claiming a federal income tax credit or deduction for the same expenses. However, because these deductions and credits are subject to income limits and their total value is limited relative to the cost of college, many families should combine them with a 529 account that funds the majority of their college costs to maximize tax efficiency.

There are three federal tax deductions or credits for college expenses: the tuition and fees deduction, the American opportunity tax credit and the lifetime learning credit. The maximum value of these benefits is a $4,000 deduction, a $2,500 credit, and a $2,000 credit, respectively. Families can only claim one of them per student per year. The highest income limit across the three programs is $180,000 for married couples filing jointly, meaning the average married Wealthfront clients earning $260,000 do not qualify for any of these deductions or credits. They also only can be claimed for tuition and fees incurred by the taxpayer(s) or their dependents (so grandparents, for example, typically cannot claim them for their grandchildren’s college expenses).

Parents who do qualify can maximize these tax benefits using the following funding strategy. By using the 529 account to fund the majority (but not all) of their college expenses they can also claim a valuable, but limited tax benefit. For example, if a child’s college education costs $30,000 per year net of financial aid, the parents can fund $27,500 of that expense using a 529 account. They can then claim a $2,500 tax credit if they pay for the remaining expenses using other (non-529) savings or income. In contrast, if the family paid the full $30,000 using a 529 account, they would not be eligible to claim a deduction or credit.

Summary

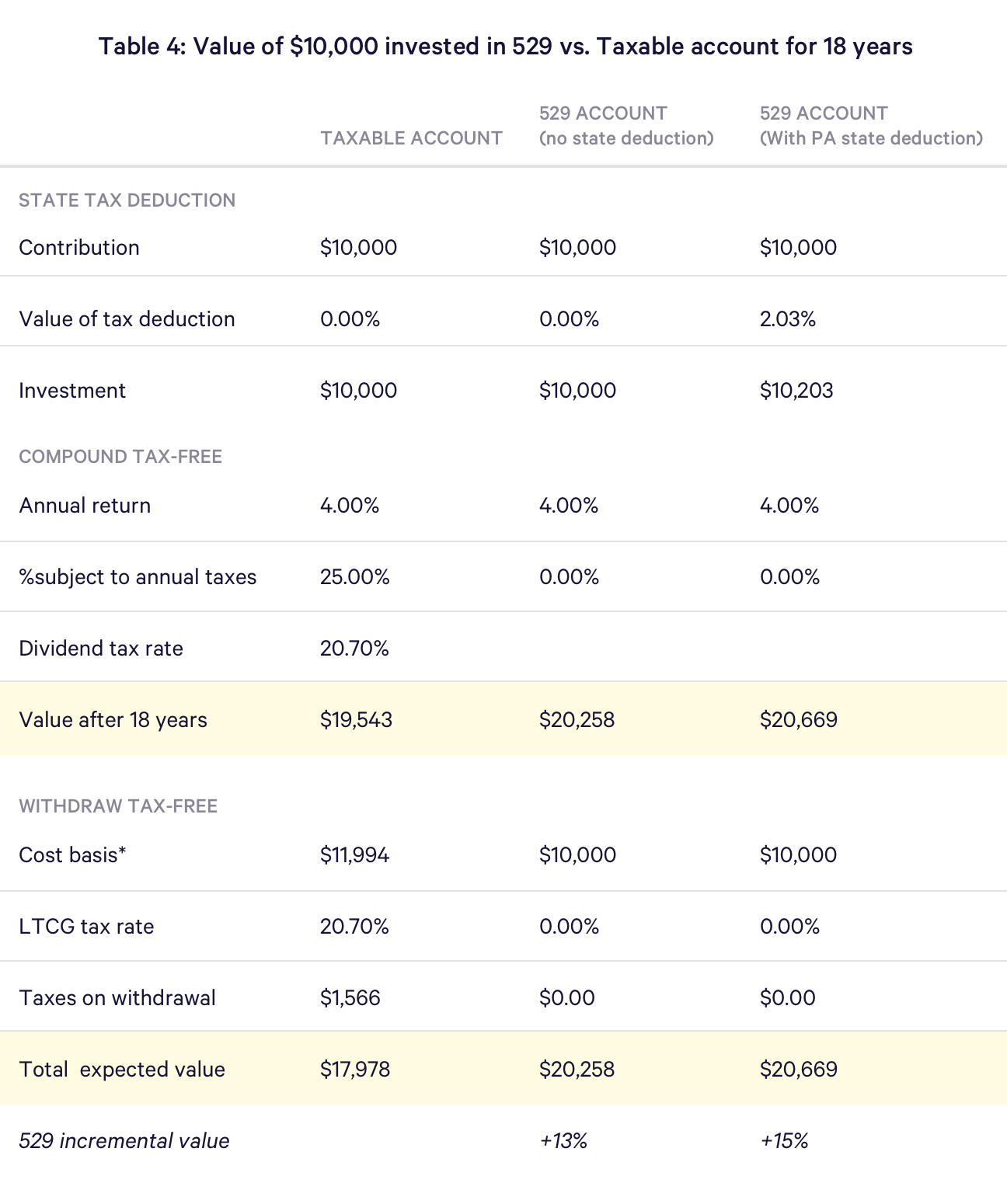

Our analysis shows that, relative to other account types, a 529 account offers significantly higher after-tax returns than a taxable account. Exhibit 4 below confirms that $10,000 invested in a 529 account for 18 years has the potential to be worth 13% more than the same amount invested in a taxable account, excluding any potential benefit from a state tax deduction. This analysis assumes that each account earns an average pretax return of 4.0% per year, 25% of the average annual return is from qualified dividends and no capital gains are recognized until liquidation. It also assumes a combined federal and state marginal tax rate of 20.7% for a married couple who jointly earn an annual income of $260,000 (the average Wealthfront married couple client) and live in Pennsylvania.

Pennsylvania is also the largest state that offers a tax deduction for contributions to any 529 plan. If the same couple were to contribute the value of that deduction to their 529 account, we estimate they will end up with 15% more than what they would have with a taxable account. This estimate is based on Pennsylvania 529 account owner’s ability to deduct contributions up to a limit of $28,000 and their marginal state income tax rate is 3.07% (compared to an average of 4.51% for couples earning $260,000 across the 34 states). It also assumes the state tax savings are offset by additional federal taxes, which result from lower itemized deductions. This makes the value of the deduction 3.07% x (1 – 33% marginal federal income tax rate) = 2.03% or $203 based on $10,000 invested in the account. An investor would therefore have to deposit 13-15% more to her taxable account for its value to equal the 529 account’s value after 18 years. The amount of the 529 account advantage will depend on whether the state in which the account owner resides offers a tax deduction, the state income tax rate and the limit on the amount that can be deducted.

*The cost basis increase in a taxable account is equal to the cumulative value of reinvested after-tax dividends.

As you can see, the tax-efficiency of a 529 account provides a significant performance advantage. The advantage grows when you add the ability to pre-fund five years worth of contributions gift tax-free (known as “superfunding”) and the flexibility to change beneficiaries.

Disclosure

The information contained in the article is provided for general informational purposes, and should not be construed as investment advice. Nothing in this article should be construed as tax advice, solicitation or offer, or recommendation, to buy or sell any security. Financial advisory services are only provided to investors who become Wealthfront clients. This article is not intended as tax advice, and Wealthfront does not represent in any manner that the tax consequences described here will be obtained or will result in any particular tax consequence.

To calculate the potential benefit of a taxable investment account vs. a 529 account with no tax deduction vs. 529 account filing taxes in Pennsylvania, we assume a married couple filing jointly with combined federal and state long-term capital gain tax rate of 20.7%, earning 4% annually, starting with $10,000 invested for 18 years. Several processes, assumptions and data sources were used to create one possible approximation, and a different methodology may have resulted in different outcomes. This illustrative example is intended to help explain possible benefits of the 529 account and should not be relied upon for predicting future market performance. The results were achieved by means of the retroactive application of a model designed with the benefit of hindsight. The projected returns consider dividend reinvestment, and interest but do not take into consideration commissions, changing risk profiles, future investment decisions or future tax rates. Projected returns do not represent actual accounts and do not reflect the effect of material economic and market factors. Past performance is no guarantee of future results.

All investing involves risk, including the possible loss of money you invest, and past performance does not guarantee future performance. Historical returns, expected returns, and probability projections are provided for informational and illustrative purposes, and may not reflect actual future performance. Please see our Full Disclosure for important details.

Investment management and advisory services are provided by Wealthfront Advisers LLC (“Wealthfront Advisers”), an SEC-registered investment adviser, and brokerage related products, including the cash account, are provided by Wealthfront Brokerage LLC, a Member of FINRA/SIPC.

Wealthfront, Wealthfront Advisers and Wealthfront Brokerage are wholly owned subsidiaries of Wealthfront Corporation.

Copyright 2023 Wealthfront Corporation. All rights reserved.