Wealthfront Tax-Loss Harvesting

Publication date: July 1, 2025. The information in this white paper is accurate as of this date. When we make material updates, we will also update the publication date.

Summary

This white paper summarizes the motivation, design, and historical results of Wealthfront’s Tax-Loss Harvesting service. Our actual results demonstrate that Tax-Loss Harvesting significantly improves the tax efficiency and ultimately the after-tax return of Wealthfront’s taxable Automated Index Investing portfolios. But more importantly Tax-Loss Harvesting typically more than pays for our advisory fee for almost all our clients. We believe Tax-Loss Harvesting should be a fundamental component of most every individual’s investment management strategy.

What is Tax-Loss Harvesting?

Tax-Loss Harvesting is a way to make an investment portfolio work even harder – not just in generating investment returns, but by also generating tax savings.

Tax-Loss Harvesting (TLH) works by taking advantage of investments that have declined in value, which is a common temporary occurrence in broadly diversified investment portfolios. By selling investments that have declined below their purchase price, a tax loss is generated – which can be used to offset other taxable items, thus lowering the investor’s taxes.

What’s more, any investment sold in this manner can be replaced with a highly correlated alternate investment, such that the risk and return profile of the portfolio remains unchanged, even as tax savings are created. These tax savings can even be reinvested to further grow the value of the portfolio.

Wealthfront developed software to make Tax-Loss Harvesting available to all our clients. Implementing Tax-Loss Harvesting in software makes it possible to look for harvesting opportunities on a daily basis, which could result in significantly greater benefit than what could be achieved from the manual end-of-year approach typically taken by traditional financial advisors.

Tax-Loss Harvesting is a Tax-Deferral and Tax Rate Arbitrage Strategy

Tax-Loss Harvesting can be used to defer tax liabilities, not avoid them. As a result it has very little value if applied over a short investment horizon (i.e. less than two years), but can be extremely valuable if executed over a long period of time. This is best demonstrated through an example that describes the benefits under two holding period scenarios:

Scenario 1 (one-year investment horizon)

Assume you buy 1,000 shares of ETF A at a price of $100 per share for a total investment of $100,000. A few months later, the market declines to the point that ETF A is now worth $90 per share, or $90,000 total. You sell all your shares of ETF A and replace it with an equivalent amount of ETF B (500 shares at $180 per share), which tracks an index that is highly correlated to the one ETF A tracks. You now own a $90,000 position in ETF B and have realized a $10,000 short-term loss for tax purposes. ETF B closes the year at $200 per share at which time you sell your entire position. Your sale of ETF B generates a $10,000 short-term gain which balances your $10,000 short-term loss. In this case harvesting the loss in ETF A generated no value.

Scenario 2 (five year investment horizon)

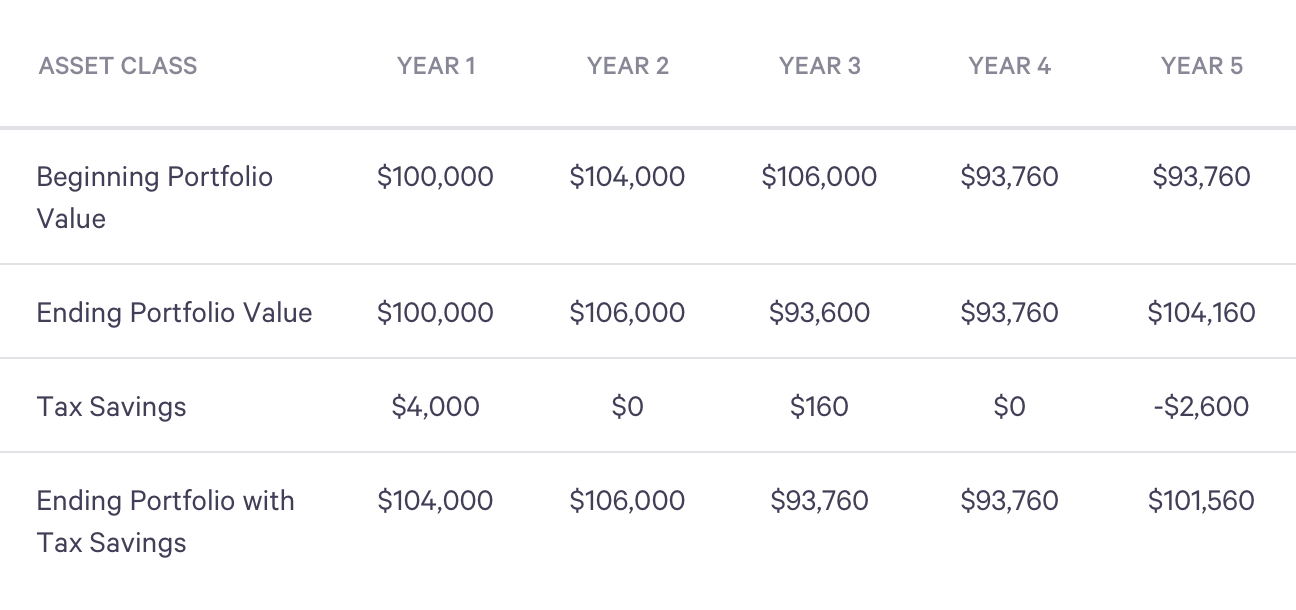

This scenario is much more complex and requires the table below to follow.

Let’s assume you started off with the exact same $100,000 investment in ETF A and a few months later it declined 10% at which time you harvested the loss and replaced it with an equivalent amount of ETF B. Once again ETF B appreciates to $100,000 by the end of the year, but this time you don’t liquidate your account. As a result your net realized short-term capital loss on this position for the year is $10,000, which generates a $4,000 tax savings when applied against your income and other realized gains under the assumption of a combined federal and state tax rate of 40%. If you reinvest that tax savings your end-of-year portfolio value is now $104,000. The next year your portfolio appreciates 1.9% to $106,000. The following year your portfolio declines in value by 11.7% to $93,600 at which time you once again harvest a loss of $400 (on your previously reinvested tax savings), which generates a $160 ($400 x 40%) tax savings for that year. You reinvest the $160 and the following two years your portfolio is flat and increases to $104,160 respectively. At the end of year 5 you liquidate the portfolio. At this point you have to pay the tax due on the $10,000 appreciation of ETF B and the $400 loss in year three that is recaptured. However, this time the gains are long-term capital gains, so you pay the lower 25% combined federal plus state tax rate, which results in a negative $2,600 cash flow ($10,400 long-term capital gain x 25%).

As you can see Scenario 2 results in a significant overall tax savings even though all of the realized losses are ultimately balanced with an equivalent realized gain. The positive economic benefit that results from this scenario can be attributed to the reinvestment of the tax savings and the significant difference in tax rates between short-term capital gains and long-term capital gains.

The value of Tax-Loss Harvesting is maximized if your portfolio is never liquidated. This is possible even when you expect to employ your portfolio for your retirement needs. For example, you can place your appreciated assets in a Charitable Remainder Trust (CRT) or similar vehicle – generating income for yourself in retirement while donating the remainder of your portfolio to a non-profit organization of your choice. Because nonprofits are not taxed, they are able to sell your highly appreciated assets and generate retirement income for you with no regard to the cost basis or tax liability of those assets.

Similarly, you can choose to pass on all or a large percentage of your portfolio to your heirs. Because your heirs receive a step-up in basis for the portfolio on your death, they are again able to take full advantage of the portfolio’s value without regard to its low cost basis or its tax liability.

Finally, instead of fully liquidating your portfolio in retirement, you can liquidate only a part of the portfolio and pass on or donate the rest. Such partial liquidation approaches, when done tax-efficiently, can again allow you to keep most of the gains of Tax-Loss Harvesting.

Who should use Tax-Loss Harvesting?

Tax-Loss Harvesting is generally valuable for all investors with taxable accounts who have a long-term investment horizon. Harvested losses can be applied to offset both capital gains and up to $3,000 in ordinary income annually. Furthermore, any losses that cannot be applied in a given tax year can be carried over indefinitely to offset future income and capital gains.

Of course, Tax-Loss Harvesting is especially valuable for investors who regularly recognize short-term capital gains. These gains can come from the sale of company stock, real estate, or just about any investment. Tax-Loss Harvesting can even be used to minimize the gains associated with liquidating a portfolio to move to a new financial advisor.

Wealthfront’s Tax-Loss Harvesting service

For taxable Automated Index Investing accounts, Wealthfront offers the Wealthfront Tax-Loss Harvesting service for no additional charge. We monitor your portfolio daily to look for opportunities to harvest losses on the ETFs that represent each asset class in your portfolio. Under the right circumstances, we will sell one of your ETFs that is trading at a loss and replace it with an alternative ETF that tracks a different, but highly correlated index to maintain the risk and return characteristics of your portfolio. We will then hold that alternative ETF in your portfolio for a minimum of 30 days to avoid wash sales, which are described below. We will not sell the alternative ETF until it can be sold for a loss, which will generate additional Tax-Loss Harvesting benefit.

The following two tables list the primary and alternative ETFs we use to represent each asset class, their associated indexes, expense ratios and correlations in monthly returns between the primary and alternative ETFs estimated using the longest common available period of data ending on December 31, 2024.

Our asset class level Tax-Loss Harvesting strategy uses a cost-benefit analysis framework to evaluate potential harvesting opportunities for each ETF lot currently trading below its cost basis. Cost is measured in two ways:

Trading Cost: this is the cost of selling the primary ETF and buying the secondary ETF. The trading cost for each ETF is simply the estimated bid-ask spread. Wealthfront clients never incur any commissions from trading.

Opportunity Cost: This is not a true “cost”, but an estimate of the expected future harvesting benefit, which is modeled by assessing the likelihood that a better harvesting opportunity is available by waiting longer to perform the Tax-Loss Harvesting trade (and thus potentially capturing a larger decline). Expected return and volatility of each asset class are used as parameters in this estimate.

The benefit of a tax-loss harvest is calculated by multiplying the potential realized capital loss incurred from selling an ETF times either the short-term or long-term capital gains tax rate, depending on the ETF’s holding period.

When the expected benefit outweighs both types of costs, we execute two trades:

- We sell the specific ETF lot to recognize a loss, and

- We purchase the same dollar amount of a similar, but not substantially identical, ETF (see Table 2 for the alternative ETFs we use for each asset class) to maintain the desired asset class exposure.

We evaluate every ETF tax lot in each eligible account every day, and execute trades when our system identifies the necessary conditions.

Wash sale management

One complexity in executing our Tax-Loss Harvesting strategy is the management of wash sales. Normally, you recognize a loss when you sell a security for less than its cost basis. However, if you buy the same or substantially identical security within 30 days of the sale, the wash sale rule applies and you are not allowed to claim the tax benefit immediately.

It should be noted that a wash sale does not completely eliminate the benefit of harvesting a loss, but only temporarily reduces that benefit by the amount of the wash sale itself. For example, if you sell 1,000 shares of a particular ETF to harvest a loss, but happen to buy 10 shares of the same ETF within 30 days, you will still be able to take advantage of the harvested loss on 990 of the 1,000 shares originally sold – as only 10 shares are actually subject to the wash sale rule in this situation. In this situation, the disallowed loss from the 10 shares where the wash sale rule applied is added to the cost basis of the 10 new shares you purchased. You can get the tax benefit of the loss when you sell the 10 new shares.

In the case of applying Tax-Loss Harvesting to a portfolio of index based ETFs, you need to use two securities that track different indexes to avoid violating the substantially identical clause of the wash sale rule. Swapping an ETF with another that tracks the same index from a different issuer (i.e. Vanguard vs. Schwab) would violate the substantially identical rule. As a result, you’ll see that the alternative ETFs presented in Table 2 track different, but highly correlated indexes from the recommended primary ETFs in Table 1.

The risk of a wash sale increases with the number of rebalancing trades made as part of the ongoing management of a portfolio. If not carefully managed, a security sold to harvest a loss might be re-purchased for another reason (change in asset allocation, rebalancing, dividend reinvestment, or deposit) and the tax benefit could be disallowed, defeating the purpose of Tax-Loss Harvesting. We carefully manage the interaction and timing of trades within our portfolio management service to help avoid wash sales.

The situation becomes more complex in the case of multiple accounts, as the wash sale rule applies to all of an investor’s accounts including IRAs – as well as spousal accounts for joint filers. For example, if an investor sells a security in her personal non-retirement account and repurchases it within 30 days in her IRA, it’s considered a wash sale; if her spouse purchases the same security within 30 days in his personal non-retirement account, it’s also viewed as a wash sale. Wealthfront monitors all the accounts it manages for each client to avoid any transactions that might trigger a wash sale. Additionally, clients can link a spousal account to ensure that wash sales are not generated across accounts belonging to the same taxable household. We urge all our clients to consult with their tax advisors to confirm that our Tax-Loss Harvesting strategies are right for them.

Measuring Tax-Loss Harvesting

A basic measure we use to quantify Tax-Loss Harvesting is called Harvesting Yield. This measures the quantity of harvested losses (both short- and long-term) during a given period, as a fraction of the portfolio’s value.

We calculate daily Harvesting Yield using the following formula: Definitions:

Definitions:

- STCL is the short-term net capital loss realized

- LTCL is the long-term net capital loss realized

- PortfolioBeginningBalance is the value of the portfolio at the beginning of each year

To arrive at annual figures, we sum the Harvesting Yield for each day within a given year.

Economic Value of Tax-Loss Harvesting

The economic value of Tax-Loss Harvesting depends on a broad range of assumptions describing the specifics of the client’s tax situation. For example, (a) the availability of taxable income which may be offset with harvested losses (short-term capital gains, long-term capital gains, and up to $3,000 in ordinary income per year); (b) the tax rates (both federal and state) applicable to the income being offset; (c) the client’s tax rate at the time the portfolio used to generate the tax losses is liquidated (which can change due to changes in tax policy or changes in income); (d) the client’s investment horizon; (e) the rate of return on reinvested tax savings; and (f) the frequency with which you add deposits to your portfolio.

Tax Savings and Liabilities

- Amount Offset is amount of tax losses utilized

- Current Tax Rate is the combined federal + state tax rate applicable to the taxable item being offset (ordinary income, short-term capital gains, or long-term capital gains) adjusted for the deductibility of state taxes at the federal level.

And the present value of the increased tax liability is represented by the following formula:

- Amount Offset is amount of tax losses utilized

- Future Tax Rate is the long-term capital gains rate prevailing at liquidation

- Discount Factor is a discount applicable to payments occurring in the future to account for the time value of money. It is given by (1 + r)-T, where r is the assumed annual rate of return on the reinvested tax savings, and T is the number of years until projected portfolio liquidation.

The client benefits from the deferral of taxation, as well as the difference between the tax rates applicable today and the lower, long-term capital gains rate, which will apply to the portfolio gains at that time. In some instances, described earlier, clients may even be able to avoid taxation altogether.

Example

To illustrate the potential economic value of Tax-Loss Harvesting, let’s consider an example where a client has an investment portfolio worth $100,000 and has harvested $4,500 in tax losses in a given year, reflecting a Harvesting Yield of 4.5%. We will show later that this Harvesting Yield is slightly lower than the cross-vintage average realized experience of clients with risk score 8.0 taxable portfolios, the most commonly selected risk score among our clients. Further suppose that the client has generated $1,000 in short-term capital gains (either at Wealthfront or elsewhere), and $2,000 of long-term capital gains (again either at Wealthfront or elsewhere). The $4,500 of harvested losses could be used to offset $1,000 of short-term capital gains, $2,000 of long-term capital gains, and $1,500 of ordinary income.

To give a sense of the range of economic benefits generated, we consider two clients differing in their tax burden. The client subject to the lower tax burden faces a combined tax rate of 25% on ordinary income and short-term capital gains, and 15% on long-term capital gains today. The client subject to the higher tax burden faces a combined tax rate of 45% on ordinary income and short-term gains, and 25% on long-term capital gains. We’ll assume that each client intends to completely liquidate the portfolio in 20 years, at which point their gains will be subject to taxation at long-term capital gains rates, equal to those prevailing today (15% for the low tax burden client, and 25% for the high-tax burden client). For the discount rate, we use 8%, which is slightly lower than the average return of clients invested in taxable accounts with a risk score of 8.0, our average and most common risk score. Table 3 below computes the tax savings, present value of the increased tax liability, and the net economic benefit to each client type.

When expressed as a fraction of the portfolio value, this economic benefit amounts to an incremental return of 0.78% in the current year for the client facing the low tax burden, and an incremental return of 1.38% for the client facing the high tax burden. Both of these values compare very favorably with Wealthfront’s annual advisory fee of 0.25% for its Automated Index Investing accounts.

In these examples, the client was able to use the full amount of the harvested losses ($4,500). If the client did not have sufficient taxable gains or remaining ordinary income credit in a given year to take advantage of the full amount of the harvested losses, the excess losses are carried forward indefinitely for use in subsequent years.

Finally, it is worth pointing out that an increase in future tax rates may decrease or increase the economic benefit of the harvested losses, depending on when the losses are realized. If tax rates were to double between the time of the harvest and time of liquidation, to 30% and 60% for the client with low tax burden and high tax burden, the economic benefits would decrease to 0.64% and 1.14% of the portfolio value – still large multiples of Wealthfront’s annual advisory fee. However, if tax rates rise over time, losses harvested from later deposits will have a higher initial tax benefit. The later losses will be more likely to maintain a larger difference between the tax rate applied at the time the loss is harvested and the time of final liquidation.

As you can see, the precise details of the computation determining the value of Tax-Loss Harvesting are significantly affected by the particulars of each client’s tax situation. In general, the greater the wedge between the tax rate applicable to the income items being offset today and the long-term capital gains rate applicable when the portfolio is liquidated, the greater the economic benefit of Tax-Loss Harvesting. Similarly, the longer the time between the client’s investment horizon, and the higher interest rates, the lower the present value of the future tax liability, and thus, the greater the benefit of Tax-Loss Harvesting.

Tax-Loss Harvesting can add more value to clients who make regular deposits into their accounts compared to ones who make a single deposit when the account is opened and never add any more funds. That’s because losses are more likely to be found in recently-purchased holdings that have not had as much time to appreciate. If you add more deposits, you have more recently purchased holdings.

An example can help make this more clear. Let’s say two investors both choose a portfolio that returns 8% per year, and that the assets in the portfolio always yield 5% in losses in the first year after purchase, and no more losses after the first year. Investor A makes a single deposit of $10,000, and no more after that. This investor harvests $500 in losses in the first year, but no losses in subsequent years. Investor B makes an initial deposit of $10,000 and follow-on deposits of $2,500 at the beginning of each subsequent year. This investor harvests $500 in losses in the first year, and then $125 in losses in each following year. The table below shows the portfolio value and total losses harvested for each investor over a 10-year period. At the end of 10 years, Investor A has an average annual harvesting yield of 0.50%, while Investor B has an average annual harvesting yield of 0.94%.

Actual Results

This section examines the loss-harvesting results experienced by Wealthfront clients since the launch of the service in October 2012.

Realized Harvesting Yields

In order to analyze the harvesting yields realized by clients, we aggregate clients into cohorts based on the year in which they first started using TLH (i.e. the client “vintage”) and their risk score. The vintage is a fixed client characteristic, but clients can move across risk score groupings based on their risk score on a given day in the sample. On each day, we compute the aggregate losses harvested within portfolios of clients belonging to a given cohort, sum these losses across clients in the cohort, and divide them by the aggregate portfolio balance of clients belonging to the cohort, to obtain that day’s Harvesting Yield. We then compute an annualized “since inception” Harvesting Yield for each cohort, by averaging the daily Harvesting Yield figures, and multiplying by 252 (the number of trading days in a year). The annualized Harvesting Yields for each vintage by risk score cohort are reported in Table 5. The data include all tax losses harvested through December 31, 2024. For brevity, we round the risk score of each client to the nearest whole number when computing the aggregates. For example, the row labeled “Risk score 5” includes accounts with risk scores between 4.5 and 5.4.

Within any given vintage year, the realized Harvesting Yield generally increases with portfolio risk score, because higher risk levels result in higher allocations to more volatile asset classes (such as stocks) and will thus result in more harvesting opportunities. This pattern plays out across risk scores within a vintage year, as well as in the cross-vintage average figures, reported in the column titled “AVG.” That being said, you should not increase your risk level in an attempt to get more Tax-Loss Harvesting benefit, because it is more likely to lead to a level of portfolio volatility that may cause you to prematurely liquidate and lose money (see DALBAR analysis).

The second pattern that can be observed in client data is that the Harvesting Yields can vary substantially across vintages for a given risk score. This is because each vintage experiences a different set of market conditions, which affect the scope of the harvesting opportunities. For example, the periods in which markets experience large peak-to-trough swings, generally create more Tax-Loss Harvesting opportunities than placid periods. The 2022 vintage is the most striking example of this. Clients who made their first deposits in early 2022 were able to harvest large amounts of losses when markets declined throughout that year.

The last two rows in the table provide summary statistics indicating the scope of harvesting opportunities. The “Market Volatility” row shows the annualized volatility of the VOO ETF, which tracks the S&P 500, from the first trading day of each year through the final date in our sample (December 31, 2024). The “Maximum Market Drawdown” row reports the maximum loss that an investor in the VOO ETF would have sustained between the first business day of each vintage and the last calendar day of our sample. For example, a maximum drawdown of 0% for the 2013 vintage means that at no point subsequent to the initial investment (made on January 2, 2013) through the end of the sample was VOO below its value on the first business day of 2013. Similarly, for the 2016 vintage, the largest cumulative drop experienced by an investor who made their initial investment on January 4, 2016 (the first business day of 2016) through the end of the sample was 10.29%.

Within each risk score, there is a strong positive correlation between the annualized harvesting yields realized by the different cohorts and both the volatility and the maximum drawdown realized by the market over the corresponding time period. Importantly, even for vintages where markets were broadly trending up (i.e. the maximum VOO drawdown was zero), our Tax-Loss Harvesting service can still take advantage of intermediate market swings to harvest losses. This reflects a meaningful advantage of Tax-Loss Harvesting that monitors for losses daily relative to more traditional approaches, such as year-end Tax-Loss Harvesting.

Table 6 shows harvesting yields for trailing periods of various lengths for accounts with a risk score of 8.0 (the risk score most commonly chosen by our clients), broken out by the client vintage.

Value Of Tax-Loss Harvesting Relative To Our Fee

Next, we examine the ability of Tax-Loss Harvesting to pay for itself, by providing tax benefit in excess of Wealthfront’s annual 0.25% advisory service fee for its Automated Index Investing accounts (which also includes automatic rebalancing, dividend reinvestment, and tax-efficient withdrawals). In this analysis, we estimate tax rates for each client based on the income, marital status, and state of residence provided during the account signup process. The tax rates and income brackets we use are the ones effective for the 2024 tax year. For each client, we calculate the total amount of long-term and short-term losses harvested during the lifetime of their account, and use the appropriate estimated tax rates to compute a total estimated tax benefit. We then compare this total benefit to the total advisory fee paid by the client.

Calculating the tax benefit of harvested losses requires some assumptions beyond the tax rate levels. We use the following methodology:

- Long-term losses are multiplied by the client’s estimated long-term capital gains tax rate. This is the sum of the federal capital gains rate and marginal state income tax rate.

- Short-term losses are multiplied by the client’s estimated short-term capital gains rate. This is the sum of their marginal federal and state income tax rates.

The analysis assumes full utilization of losses to offset gains. In reality this may not be the case – some may rarely make withdrawals from their accounts and may not have any capital gains to offset. However, we should remember that excess losses after all capital gains have been offset can be used to offset up to $3,000 of income per year, and any excess still remaining after that can be carried over indefinitely into the future. Income is taxed at a higher rate than long-term capital gains, so losses are more valuable when used to offset income as compared to long-term gains.

We find that the median ratio of tax benefit to fee is 5.5x, meaning that for a typical client, our Tax-Loss Harvesting service is paying for itself more than five times over and more than 95% of clients who used Tax-Loss Harvesting for at least a year received more in estimated tax benefit than they paid in fees. The small minority of clients whose tax benefit has not exceeded their total fee tend to be invested in lower-risk portfolios and live in states with low or no taxes.

Benefit of Checking for Losses Daily

Wealthfront’s Tax-Loss Harvesting uses software to check for opportunities to harvest losses daily, which means it can take advantage of market volatility throughout the year and potentially harvest more losses compared to checking only at the end of the year. To show the value of looking for losses daily, we calculate the average fraction of yearly losses harvested in each calendar month, for our Classic ETF portfolios from 2013 through the end of 2024. Figure 1 shows the average percentages for each month. Although there is variation, our service harvests a meaningful amount of losses each month, suggesting a significant benefit to harvesting through the year rather than only once at the end of the year (by which time some harvesting opportunities from early in the year may have disappeared). This highlights why software is the ideal way to implement tax-loss harvesting – it would be extremely time-consuming for a human to check for losses and perform loss-harvesting trades as frequently as our software can.

Final Considerations

Tax-Loss Harvesting may be a highly valuable way to improve the tax efficiency of your portfolio, but it’s important to understand that it is a tactical approach and should not interfere with your strategic investment objectives such as broad diversification through an optimal asset allocation, disciplined and tax-efficient rebalancing and low-cost indexing.

Since Tax-Loss Harvesting systematically lowers the cost basis of a portfolio by replacing securities (ETFs or stocks) that trade at a loss, investors might be concerned with how to deal with a portfolio with a low cost basis in the future. Generally speaking, portfolios with a low cost basis require more careful disposition. Investors may choose to minimize their tax liabilities that result from Tax-Loss Harvesting by using the low basis portfolio as a charitable donation or passing the portfolio on to heirs through an estate at a stepped-up cost basis.

Tax-Loss Harvesting is only relevant for taxable accounts. It does not apply to tax-deferred accounts such as IRAs and 401(k) accounts, since gains and losses in those accounts are not taxable events. However alternative ETFs may need to be used when investing your tax deferred account to avoid wash sales. Tax-Loss Harvesting is also not typically suited for custodial accounts such as UTMA/UGMA accounts unless the minor has significant taxable capital gains or income from other sources.

Conclusion

We believe the results presented in this white paper clearly demonstrate that Wealthfront’s fully automated Tax-Loss Harvesting service could significantly improve the after-tax returns for young people with a long investment time horizon, and pay for itself, often multiple times over. Our research shows that for the vast majority of clients, the benefits of Tax-Loss Harvesting significantly outweigh Wealthfront’s advisory fee. We thus believe Tax-Loss Harvesting should be a fundamental component of most every individual’s investment management strategy.

Appendix

Tax Rates

Tables 7a and 7b below display the 2025 income tax brackets for married couples filing jointly, along with the prevailing federal tax rates for ordinary income, dividends, interest, short-term capital gains, and long-term capital gains. Ordinary income rates have two components – a base rate and an additional Medicare tax of 1.45% for joint incomes of $250,000 or less or 2.35% for incomes above $250,000. Taxpayers with joint incomes above $250,000 also pay an additional 3.8% Net Investment Income Tax on all capital gains, dividends, and interest.

In addition to the above federal tax rates, income and capital gains are subject to taxation at the state level. State tax rates vary considerably, from no income tax to rates of over 12% for those in the highest brackets in California. As such, your income and short-term capital gains can be subject to taxation ranging from roughly 10% (lowest federal tax bracket + no state tax) to over 50% (highest federal tax bracket + highest California tax brackets). Long-term capital gains are subject to lower levels of taxation, varying from 0% to over 30%.

Disclosure

This white paper is as of July 1, 2025 and Wealthfront disclaims any undertaking to update this white paper after this date, even if in the future Wealthfront’s assumptions would be different or if Wealthfront changes its Tax-Loss Harvesting methodologies described in this white paper.

This white paper was prepared to support the marketing of Wealthfront’s investment products, as well as to explain its Tax-Loss Harvesting strategies. Nothing in this white paper should be construed as tax advice, a solicitation or offer, or recommendation, or to buy or sell any security. While the data Wealthfront uses from third parties is believed to be reliable, Wealthfront does not guarantee the accuracy of the information.

Wealthfront does not represent in any manner that the tax consequences described herein will be obtained or that Wealthfront’s Tax-Loss Harvesting strategies, or any of its products and/or services, will result in any particular tax consequence. The tax consequences of the Tax-Loss Harvesting strategy and other strategies that Wealthfront may pursue are complex and uncertain and may be challenged by the Internal Revenue Service (IRS). This white paper was not prepared to be used, and it cannot be used, by any investor to avoid penalties or interest.

Wealthfront Advisers and its affiliates do not provide legal or tax advice. Prospective investors should confer with their personal tax advisors regarding the tax consequences of investing with Wealthfront and engaging in these tax strategies, based on their particular circumstances. Investors and their personal tax advisors are responsible for how the transactions conducted in an account are reported to the IRS or any other taxing authority on the investor’s personal tax returns. Wealthfront assumes no responsibility for the tax consequences to any investor of any transaction.

Wealthfront’s investment strategies, including portfolio rebalancing and tax loss harvesting, can lead to high levels of trading. High levels of trading could result in (a) bid-ask spread expense; (b) trade executions that may occur at prices beyond the bid ask spread (if quantity demanded exceeds quantity available at the bid or ask); (c) trading that may adversely move prices, such that subsequent transactions occur at worse prices; (d) trading that may disqualify some dividends from qualified dividend treatment; (e) unfulfilled orders or portfolio drift, in the event that markets are disorderly or trading halts altogether; and (f) unforeseen trading errors. The performance of the new securities purchased through the Tax-Loss Harvesting service may be better or worse than the performance of the securities that are sold for Tax-Loss Harvesting purposes.

Tax loss harvesting may generate a higher number of trades due to attempts to capture losses. There is a chance that Wealthfront trading attributed to tax loss harvesting may create capital gains and wash sales and could be subject to higher transaction costs and market impacts. In addition, tax loss harvesting strategies may produce losses, which may not be offset by sufficient gains in the account and may be limited to a $3,000 deduction against income. The utilization of losses harvested through the strategy will depend upon the recognition of capital gains in the same or a future tax period, and in addition may be subject to limitations under applicable tax laws, e.g., if there are insufficient realized gains in the tax period, the use of harvested losses may be limited to a $3,000 deduction against income and distributions. Losses harvested through the strategy that are not utilized in the tax period when recognized (e.g., because of insufficient capital gains and/or significant capital loss carryforwards), generally may be carried forward to offset future capital gains, if any.

Wealthfront only monitors for Tax-Loss Harvesting for accounts within Wealthfront. The client is responsible for monitoring their and their spouse’s accounts outside of Wealthfront to ensure that transactions in the same security or a substantially similar security do not create a “wash sale.” A wash sale is the sale at a loss and purchase of the same security or substantially similar security within 30 days of each other. If a wash sale transaction occurs, the IRS may disallow or defer the loss for current tax reporting purposes. More specifically, the wash sale period for any sale at a loss consists of 61 calendar days: the day of the sale, the 30 days before the sale, and the 30 days after the sale. The wash sale rule postpones losses on a sale, if replacement shares are bought around the same time. Wealthfront may lack visibility to certain wash sales, should they occur as a result of external or unlinked accounts, and therefore Wealthfront may not be able to provide notice of such wash sales in advance of the Client’s receipt of the IRS Form 1099.

The effectiveness of the Tax-Loss Harvesting strategy to reduce the tax liability of the client will depend on the client’s entire tax and investment profile, including purchases and dispositions in a client’s (or client’s spouse’s) accounts outside of Wealthfront and type of investments (e.g., taxable or nontaxable) or holding period (e.g., short- term or long-term). Except as set forth above, Wealthfront will monitor only a client’s (or client’s spouse’s) Wealthfront accounts to determine if there are unrealized losses for purposes of determining whether to harvest such losses. Transactions outside of Wealthfront accounts may affect whether a loss is successfully harvested and, if so, whether that loss is usable by the client in the most efficient manner.

A client may also request that Wealthfront monitor the client’s spouse’s accounts or their IRA accounts at Wealthfront to avoid the wash sale disallowance rule. A client may request spousal monitoring online or by calling Wealthfront at (844) 995-8437. If Wealthfront is monitoring multiple accounts to avoid the wash sale disallowance rule, the first taxable account to trade a security will block the other account(s) from trading in that same security for 30 days.

All investing involves risk, including the possible loss of money you invest, and past performance does not guarantee future performance. Please see our Full Disclosure for important details.

Investment management and advisory services are provided by Wealthfront Advisers LLC (“Wealthfront Advisers”), an SEC-registered investment adviser. Brokerage products and services are offered by Wealthfront Brokerage LLC (“Wealthfront Brokerage”), member FINRA / SIPC. Wealthfront Advisers, Wealthfront Brokerage and Wealthfront are wholly owned subsidiaries of Wealthfront Corporation.

© 2025 Wealthfront Corporation. All rights reserved.

Sections

- Summary

- What is Tax-Loss Harvesting?

- Tax-Loss Harvesting Is a Tax-Deferral and Tax Rate Arbitrage Strategy

- Who Should Use Tax-Loss Harvesting?

- Wealthfront’s Tax-Loss Harvesting service

- Wash Sale Management

- Measuring Tax-Loss Harvesting

- Economic Value of Tax-Loss Harvesting

- Tax Savings and Liabilities

- Example

- Actual Results

- Realized Harvesting Yields

- Value of Tax-Loss Harvesting Relative To Our Fee

- Benefit of Checking for Losses Daily

- Final Considerations

- Conclusion

- Appendix

- Tax Rates

- Disclosure